Project Econergy – Solar Photovoltaic Portfolio Acquisition and Refinancing

Structuring and execution of the acquisition and refinancing under a single umbrella facility of 11 SPVs, owning and operating 30 solar PV plants for an aggregate capacity of 34MWp.

Buy side advisory mandate in respect of all the aspects of the refinancing and purchase process:

- Development of the financial model and preliminary valuation

- Structuring of the transaction, debt sizing and marketing

- Fine tuning of the refinancing financial model based on lenders feedback, running of key sensitivities and audit process

- Data room population and management

- Coordination of the Due Diligence streams (legal, technical and administrative) and supervision of the advisors appointed by the client and by the lenders

- Advised the client in the negotiation and drafting of the commercial terms of the Facility Agreement and the Share Purchase Agreement

- The refinancing delivered a single long tenor facility with bond-like pricing financing both the repayment of the existing loans at SPVs level and partially the equity of the acquisition

Transaction: Structuring, refinancing and acquisition

Value: c. EUR 130m.

Project Garbagnate: Refinancing and PPP hospital Sale

Refinancing and sale of Garbagnate hospital in Lombardy, a long term concessionaire owned by Pessina Costruzioni S.p.A., to a UK infrastructure fund.

First refinancing in Italy in the PPP hospital sector through a EUR 30 million project bond (15-year maturity) and a EUR 15 million bank debt.

Sell side advisory mandate in respect of all the aspects of the sale process of Garbagnate Salute S.p.A., a long term hospital concessionaire owned by Pessina Costruzioni S.p.A.:

- Advising the client on the best financial structure to maximize the exit value

- Preliminary valuation and fine tuning of the vendor model

- Information package set up, road show and beauty contest management

- Advising the client in the non binding offer and binding offers and structuring of the transaction

- Q&A with the buyer and active management of the data room

- Coordination of the Due Diligence streams (legal, technical and administrative) and supervision of the advisors appointed by the client

- Advised the client in the negotiation and drafting of the commercial terms of the Share Purchase Agreement

- Coordination of the process with existing lenders to obtain the waivers requested as part as the transaction

Transaction: Structuring and execution

Value: c. EUR 150m.

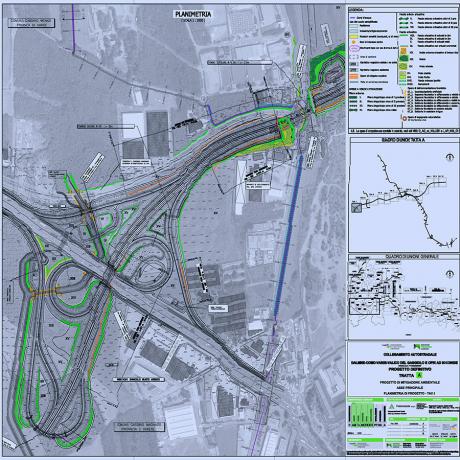

Project Serravalle: Corporate Finance Advisor

Advised the Italian motorway concessionaire Milano Serravalle on the fair value of its shares and on its equity and debt raising options.

Financial advisory assignment in respect of the assessment of the fair value of the shares and funding options for the acquisition of 30% of the shares owned by local public sector bodies:

- Analysis of the Milano Serravalle group business, financial models review and fairness opinion on the shares value

- Assessment of the financial impact of the shares purchase by the company

- Analysis of the additional equity/debt resources to liquidate shareholders

- Analysis of loan agreements in place and assessment of the impact of the shares purchase on the financial covenants in place

- Financial institutions and debt providers market testing to fund the repurchasing of the shares

- Market testing of equity investors to acquire the shares

Transaction: Corporate Finance advisory

Value: over EUR 600m.

Project Mar-Ter and Neri: Acquisition advisory

Prothea acted as advisor to Palladio Finanziaria for the acquisition of Mar-Ter Neri. Mar-Ter Neri is the Italian market leader for pulp port logistics based on two port terminals in Leghorn and Monfalcone.

Mar-Ter-Neri was created as a group by Mid Industry Capital, an Italian based private equity sponsor through the acquisition and subsequent merger of the two entities.

Founded in 1969 by the Bortolussi family, Mar-Ter is a port logistics operator based in Monfalcone, active in the handling, storage and distribution of raw materials for the paper and other industries.

Neri is a port logistics operator based in Leghorn active in the handling, storage and distribution of paper, pulp, timber and forest products and non-ferrous metals such as copper, zinc and lead.

Transaction: Buy side advisor

Value: c. EUR 60m.